Personal loans are among the most accessible types of credit facilities available today. They are typically unsecured loans, which means that you do not have to offer any assets to the lender as collateral. Although many people are aware of personal loans, several personal loan myths persist even today, despite growing financial literacy.

If you believe in any of the many personal loan misconceptions popular nowadays, you may not be able to make optimal financial decisions. This is why it is crucial to separate personal loan facts from personal loan myths. And that is exactly what this article can help you with. Let us get started by discussing the meaning of an unsecured personal loan.

1. What is an Unsecured Personal Loan?

An unsecured personal loan is a type of credit facility that does not require any collateral. The lender decides the borrower’s eligibility based on other factors, like their credit score, credit history, income level, stability of income, and debt-to-income ratio.

The key features of an unsecured personal loan include the following:

- No Collateral

To obtain this type of financing, you do not need to offer the lender any assets as collateral. So, your home, gold jewellery or other investments are not pledged to borrow. - Higher Interest Rates

Personal loans carry higher interest rates because they are unsecured borrowings. Since the lender has no collateral to offset the risk of default, they charge more interest. - Short Repayment Tenure

The repayment tenure of unsecured personal loans typically ranges from one to five years. This is shorter than the repayment tenure of secured borrowings like home loans, which may stretch to 20 or 30 years. - Credit-Based Approval

Lenders need to assess a borrower’s risk profile based on their credit profile, income profile, and overall financial health.

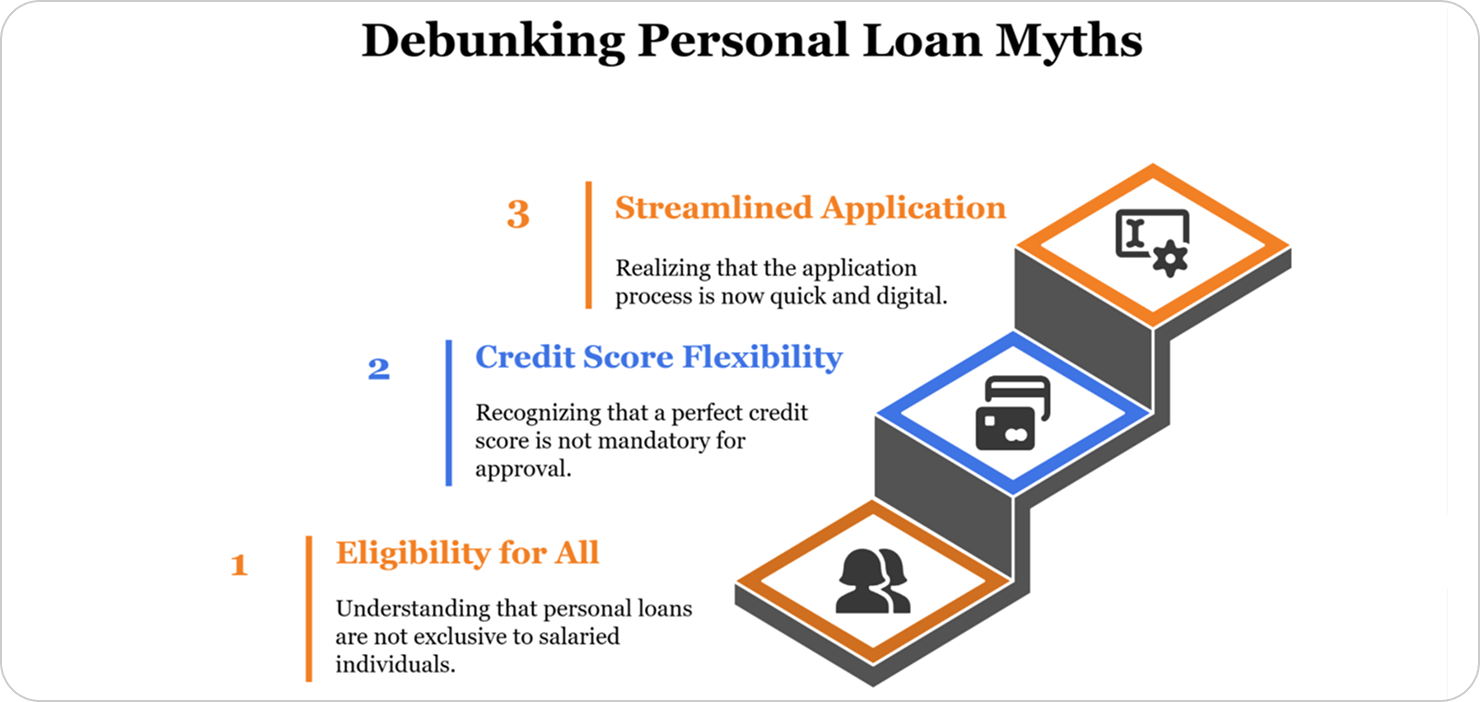

Top 3 Myths About Unsecured Personal Loans

With financing more easily available nowadays, an increasing number of people have access to personal loans. However, despite this growing accessibility, awareness remains limited, and many people believe in myths about unsecured loans like personal loans.

So, now that you know what a personal loan is, let us discuss what it is not. Here are the top personal loan myths to debunk, so you can make smarter financial decisions if you need to borrow money.

1. Only Salaried Applicants are Eligible

It is a common misconception about personal loans that only salaried employees can get approval. This could not be further from the truth about personal loans. Whether you are a business owner, a freelancer, or a consultant, you can still apply for this type of credit facility, provided you meet the lender’s eligibility criteria regarding your income and credit profile.

Lenders today assess the stability and consistency of your income rather than just where it comes from. So, if you run a small business with steady profits or freelance with recurring contracts, you may still qualify. Unfortunately, since many people believe in the personal loan myth that it is only for salaried applicants, they are not aware of how flexible the borrowing can be.

Of course, self-employed applicants may need to provide more documentation, like bank statements, tax returns, or business income records. This is to demonstrate their financial stability. However, do not let these extra steps fool you into thinking you are already ineligible. You only need to meet the lender’s criteria and follow the steps needed to apply for the loan.

2. You Need a High Credit Score to Obtain a Personal Loan

One of the more persistent unsecured loan myths is that a personal loan is difficult to obtain if you do not have a perfect credit score. This is not entirely true. While your credit history does play a role, lenders do not expect you to have a flawless record. A moderate score with stable income and low debt can still help you get approved.

Lenders will look at your overall financial profile. This includes your current income, existing EMIs, and repayment history. So, even if your score is not ideal, showing that you earn regularly and repay debts on time improves your chances. This is a classic example of a personal loan myth overshadowing the real approval process.

In fact, many lenders now offer loans specifically designed for applicants with average credit. These may come with slightly higher interest rates or smaller loan amounts, but they still serve the purpose. Understanding this personal loan truth can make it easier for you to apply confidently for financing, instead of holding back due to unnecessary personal loan misconceptions.

3. The Personal Loan Application Process is Lengthy

Thanks to digital lending platforms, applying for a personal loan has never been easier. Still, many people believe the process takes weeks and involves stacks of paperwork. This is one of the most outdated personal loan myths. In reality, hundreds of applications are processed and approved within a single day.

Online lenders have simplified everything, right from KYC verification to income and credit checks. You can also quicken the process by uploading your documents digitally and submitting the correct details in your loan application. If your paperwork is in order, you may even get approval within hours. This personal loan fact is often overlooked because people assume all loans follow slow, traditional routes.

What’s more, many banks, NBFCs, and lending platforms now offer pre-approved loans to eligible users. These loans are disbursed almost instantly. Such fast-track options prove that this is just another unsecured loan myth that no longer applies. You must not let outdated notions keep you from exploring timely financial solutions when needed.

Things to Keep in Mind Before Obtaining an Unsecured Personal Loan

In addition to debunking the common personal loan myths, it is also crucial to know certain key aspects of borrowing through this channel. Here are some important things to keep in mind if you want to apply for an unsecured personal loan.

The key features of an unsecured personal loan include the following:

- The Total Cost of Borrowing

Always look beyond the advertised interest rate. Factor in the processing fees, prepayment penalties, and late charges. These hidden costs can significantly raise the actual cost of your loan if you are not careful at the outset. - The Flexibility of Repayment

Check if the lender allows part-prepayments or early closures without steep penalties. Flexible repayment options can help you reduce interest outgo over time. Rigid repayment structures, on the other hand, can strain your finances if your income pattern changes unexpectedly. - The Impact on Your Monthly Budget

Do not borrow based on eligibility alone. Analyse how the EMI fits into your monthly budget along with other expenses like rent, bills, savings, and other debts. Overstretching your finances can make you miss crucial repayments. This will hurt your credit score. - The Purpose of Borrowing

Unsecured personal loans are best suited for genuine needs like emergencies, education, or consolidating high-interest debt. If you use them for luxury purchases or impulsive spending, you may be trapped in an unnecessary debt cycle - The Fine Print

Before you sign the loan agreement, read every clause in it, particularly the parts around defaults, interest recalculations, and hidden fees. Some lenders may include conditions that are difficult to spot upfront if you don’t know what to look for. - The Impact on Your Credit Score

A personal loan can improve or harm your credit score depending on how you manage it. Repaying your EMIs in a timely manner can boost your profile, while defaults can reduce the score significantly. So, you must treat it as a responsibility rather than just a transaction

Conclusion

This brings us to the end of our guide on the common personal loan myths and the truths behind them. With this knowledge of the key personal loan facts and the important aspects to consider before you borrow money, you can make a better decision about any new debt you intend to take on. Keep in mind that when it comes to any financial product, whether it is a personal loan, credit card, investment or any savings scheme, never believe word of mouth alone. Do your research, uncover the truth, understand the product, and only then, make a decision.